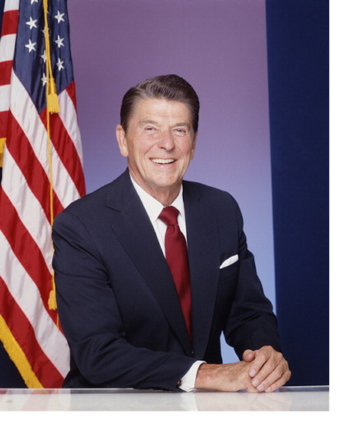

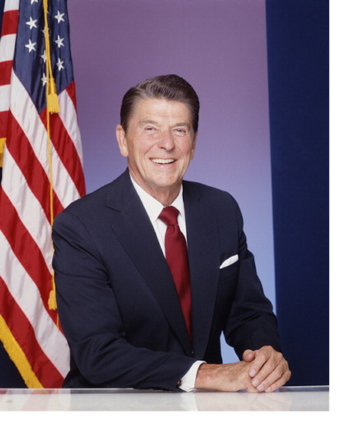

They were based on supply-side economics which prioritized tax cuts. Our secure private email service will keep your information and personal communications safe. For example,President George W. Bushcut taxes in 2001 and 2003 to fight the 2001 recession. Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types? Reagans plan revolutionized American spending and to great effect. Reagan was an effective communicator of conservative ideas, but he was also an enormously practical politician who was committed to success. ", Tax Policy Center. [9] Reagan described the new debt as the "greatest disappointment" of his presidency. For a cut in capital income taxes, the feedback is larger about 50 percent but still well under 100 percent. The effect wouldve been much weaker if the tax rate was less than 50% like it is in the present time. "H.R.1836 - Economic Growth and Tax Relief Reconciliation Act of 2001. The policies were introduced to fight a long period of slow economic growth, high unemployment, and high inflation that occurred under Presidents Gerald Ford and Jimmy Carter. Ronald Reagan (1911-2004), a former actor and California governor, served as the 40th president from 1981 to 1989. Reagan's economic policies were nicknamed Reaganomics.  Nevertheless, I have no doubt that the loose talk of the supply side extremists gave fundamentally good policies a bad name and led to quantitative mistakes that not only contributed to subsequent budget deficits but that also made it more difficult to modify policy when those deficits became apparent.[119]. However, tax cuts in 1986 and 1987 weren't as effective because tax rates were already reasonable. In a deeply controversial move, he also ordered the Social Security Administration to tighten enforcement on disabled recipients, ending benefits for more than a million recipients. Despite campaigning on reduced government spending, Reagan wasn't as successful with this as he was with tax cuts. President Reagan was a strong believer in free [31], Federal revenue share of GDP fell from 19.6% in fiscal 1981 to 17.3% in 1984, before rising back to 18.4% by fiscal year 1989.

Nevertheless, I have no doubt that the loose talk of the supply side extremists gave fundamentally good policies a bad name and led to quantitative mistakes that not only contributed to subsequent budget deficits but that also made it more difficult to modify policy when those deficits became apparent.[119]. However, tax cuts in 1986 and 1987 weren't as effective because tax rates were already reasonable. In a deeply controversial move, he also ordered the Social Security Administration to tighten enforcement on disabled recipients, ending benefits for more than a million recipients. Despite campaigning on reduced government spending, Reagan wasn't as successful with this as he was with tax cuts. President Reagan was a strong believer in free [31], Federal revenue share of GDP fell from 19.6% in fiscal 1981 to 17.3% in 1984, before rising back to 18.4% by fiscal year 1989.  He raised Social Security payroll taxes and some excise taxes. The overall burden of government spending only fell by a small amount, but that number masks the fact that domestic spending was reduced significantly as a share of GDP during the Reagan years. International Inequalities Institute. The complexity meant that the overall results of his corporate tax changes couldn't be measured. His economic policies called for widespread tax cuts, decreased social spending, increased military spending, and the deregulation of domestic markets. These changes complicated tax measurements so much that the overall results of the changes are difficult to define; therefore, the results remain controversial. Reagan also offset these tax cuts with tax increases elsewhere. Reagan increased, not decreased, import barriers. Office of Management and Budget. Volcker's policytriggered the recession of 1981-1982. [50] The inflation rate, 13.5% in 1980, fell to 4.1% in 1988, in part because the Federal Reserve increased interest rates (prime rate peaking at 20.5% in August 1981[51]). Reagans plan revolutionized American spending and to great effect. I think Reagan was even better than shown by the EFW data. Based on the principles of supply-side economics and the trickle-down theory, Reaganomics proposed that decreases in taxes, especially for corporations, stimulate economic growth. As he brought taxation down from 70% to 28%, Reagan proved that reducing excessive tax rates stimulates growth, increases economic activity, and boosts tax revenues. Reaganomics (/renmks/; a portmanteau of Reagan and economics attributed to Paul Harvey),[1] or Reaganism, were the neoliberal[2][3][4] economic policies promoted by U.S. President Ronald Reagan during the 1980s. Federal Reserve History. (2006), Reaganomics: A Watershed Moment on the Road to Trumpism.The Economists Voice | Volume 16: Issue 1., This page was last edited on 27 March 2023, at 04:13. [54], The misery index, defined as the inflation rate added to the unemployment rate, shrank from 19.33 when he began his administration to 9.72 when he left, the greatest improvement record for a President since Harry S. Truman left office. WebReaganomics President Reagans supply-side economic policies, often called Reaganomics, set out to grow the economy by cutting taxes and deregulating some industries. [26], With the Tax Reform Act of 1986, Reagan and Congress sought to simplify the tax system by eliminating many deductions, reducing the highest marginal rates, and reducing the number of tax brackets. 2 3 Reaganomics and Tax [49] Reagan's administration is the only one not to have raised the minimum wage. WebDummies has always stood for taking on complex concepts and making them easy to understand. Reagan eliminated the price controls on US oil and gas prices implemented by President Nixon. In 2005 dollars, the tax receipts in 1990 were $1.5 trillion, an increase of 20% above inflation.[82]. ", Congress.gov. Although Reagan reduced the economic regulation that began under President Jimmy Carter and eliminated price controls on oil and natural gas, long-distance telephone services, and cable television, critics argue that the deregulation of the financial services industry during the Reagan administration played a part in the Savings and Loan crisis, as well as the financial collapse of 2008. President Reagan's Economic Policies Explained, Ronald Wilson Reagan was the 40th U.S. president, serving from Jan. 20, 1981,to Jan. 20, 1989. Economist Arthur Laffer developed it in 1974. Reaganomics refers to the economic policies instituted by former President Ronald Reagan. Other issues, however, such as the savings and loan problem, size of federal government, and tax revenue did not see much change. These same cuts have a multiplier effect on economic growth. Reagan promised the "Reagan Revolution," focusing on reducinggovernment spending, taxes, andregulation. Reagans plan revolutionized American spending and to great effect. Reagan's first tax cuts worked because tax rates were high when he entered office. This strategy emphasized supply-side economics as the best way to grow an economy. WebIn foreign policy, President Reagan sought to assert American power in the world.

He raised Social Security payroll taxes and some excise taxes. The overall burden of government spending only fell by a small amount, but that number masks the fact that domestic spending was reduced significantly as a share of GDP during the Reagan years. International Inequalities Institute. The complexity meant that the overall results of his corporate tax changes couldn't be measured. His economic policies called for widespread tax cuts, decreased social spending, increased military spending, and the deregulation of domestic markets. These changes complicated tax measurements so much that the overall results of the changes are difficult to define; therefore, the results remain controversial. Reagan also offset these tax cuts with tax increases elsewhere. Reagan increased, not decreased, import barriers. Office of Management and Budget. Volcker's policytriggered the recession of 1981-1982. [50] The inflation rate, 13.5% in 1980, fell to 4.1% in 1988, in part because the Federal Reserve increased interest rates (prime rate peaking at 20.5% in August 1981[51]). Reagans plan revolutionized American spending and to great effect. I think Reagan was even better than shown by the EFW data. Based on the principles of supply-side economics and the trickle-down theory, Reaganomics proposed that decreases in taxes, especially for corporations, stimulate economic growth. As he brought taxation down from 70% to 28%, Reagan proved that reducing excessive tax rates stimulates growth, increases economic activity, and boosts tax revenues. Reaganomics (/renmks/; a portmanteau of Reagan and economics attributed to Paul Harvey),[1] or Reaganism, were the neoliberal[2][3][4] economic policies promoted by U.S. President Ronald Reagan during the 1980s. Federal Reserve History. (2006), Reaganomics: A Watershed Moment on the Road to Trumpism.The Economists Voice | Volume 16: Issue 1., This page was last edited on 27 March 2023, at 04:13. [54], The misery index, defined as the inflation rate added to the unemployment rate, shrank from 19.33 when he began his administration to 9.72 when he left, the greatest improvement record for a President since Harry S. Truman left office. WebReaganomics President Reagans supply-side economic policies, often called Reaganomics, set out to grow the economy by cutting taxes and deregulating some industries. [26], With the Tax Reform Act of 1986, Reagan and Congress sought to simplify the tax system by eliminating many deductions, reducing the highest marginal rates, and reducing the number of tax brackets. 2 3 Reaganomics and Tax [49] Reagan's administration is the only one not to have raised the minimum wage. WebDummies has always stood for taking on complex concepts and making them easy to understand. Reagan eliminated the price controls on US oil and gas prices implemented by President Nixon. In 2005 dollars, the tax receipts in 1990 were $1.5 trillion, an increase of 20% above inflation.[82]. ", Congress.gov. Although Reagan reduced the economic regulation that began under President Jimmy Carter and eliminated price controls on oil and natural gas, long-distance telephone services, and cable television, critics argue that the deregulation of the financial services industry during the Reagan administration played a part in the Savings and Loan crisis, as well as the financial collapse of 2008. President Reagan's Economic Policies Explained, Ronald Wilson Reagan was the 40th U.S. president, serving from Jan. 20, 1981,to Jan. 20, 1989. Economist Arthur Laffer developed it in 1974. Reaganomics refers to the economic policies instituted by former President Ronald Reagan. Other issues, however, such as the savings and loan problem, size of federal government, and tax revenue did not see much change. These same cuts have a multiplier effect on economic growth. Reagan promised the "Reagan Revolution," focusing on reducinggovernment spending, taxes, andregulation. Reagans plan revolutionized American spending and to great effect. Reagan's first tax cuts worked because tax rates were high when he entered office. This strategy emphasized supply-side economics as the best way to grow an economy. WebIn foreign policy, President Reagan sought to assert American power in the world.  Reaganomics sought to reduce the cost of doing business, by reducing tax burdens, relaxing regulations and price controls, and cutting domestic spending programs. He raised Social Security payroll taxes and some excise taxes. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). He is a professor of economics and has raised more than $4.5 billion in investment capital. The federal debt almost tripled, from $998 billion in 1981 to $2.857 trillion in 1989. However, the economy did eventually become less volatile, and the economy entered into a period of strong growth. One of the cornerstones of President Ronald Reagans presidency, like your Reagan email, bears the name of the leader: Reaganomics. In 1982, Congress passed the Garn-St. Germain Depository Institutions Act for savings and loanbanks to deal with rising inflation and interest rates by further deregulating deposit rates. Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. ", Federal Reserve Bank of St. Louis. That's according toWilliam A. Niskanen, a founder ofReaganomics who belonged toReagan'sCouncil of Economic Advisersfrom 1981 to 1984. Bush, and 2.4% under Clinton. This painful solution was necessary to stop galloping inflation. He eased bank regulations, but that helped create theSavings and Loan Crisisin 1989.

Reaganomics sought to reduce the cost of doing business, by reducing tax burdens, relaxing regulations and price controls, and cutting domestic spending programs. He raised Social Security payroll taxes and some excise taxes. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). He is a professor of economics and has raised more than $4.5 billion in investment capital. The federal debt almost tripled, from $998 billion in 1981 to $2.857 trillion in 1989. However, the economy did eventually become less volatile, and the economy entered into a period of strong growth. One of the cornerstones of President Ronald Reagans presidency, like your Reagan email, bears the name of the leader: Reaganomics. In 1982, Congress passed the Garn-St. Germain Depository Institutions Act for savings and loanbanks to deal with rising inflation and interest rates by further deregulating deposit rates. Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. ", Federal Reserve Bank of St. Louis. That's according toWilliam A. Niskanen, a founder ofReaganomics who belonged toReagan'sCouncil of Economic Advisersfrom 1981 to 1984. Bush, and 2.4% under Clinton. This painful solution was necessary to stop galloping inflation. He eased bank regulations, but that helped create theSavings and Loan Crisisin 1989.  [65] While inflation remained elevated during his presidency and likely contributed to the decline in wages over this period, Reagan's critics often argue that his neoliberal policies were responsible for this and also led to a stagnation of wages in the next few decades. Whether Reagan's economic policies were effective depends upon your point of view. Reagan cut the tax rate again, to 38.5% this time, in 1987growth remained similar at 3.5%, and unemployment fell to 5.7%. In 1981,Reagan eliminated theNixon-era price controlson domestic oil and gas. [67] After declining from 1973 through 1980, real mean personal income rose $4,708 by 1988. WebThe endorsement of Reagan by the Protestant establishment did not deter devout Catholics from voting Republican, since Reagan promised to oppose abortion rights and promote family values. The bulk of tax cuts were aimed at the top income earners. Successes include lower marginal tax rates and inflation. Here are three reasons. By contrast, economist Milton Friedman has pointed to the number of pages added to the Federal Register each year as evidence of Reagan's anti-regulation presidency (the Register records the rules and regulations that federal agencies issue per year). In his inaugural address, President Reagan famously said, Government is not the solution to our problem; government is the problem. Reagan increased thedefense budgetby 35% to accomplish these goals. Total federal outlays averaged of 21.8% of GDP from 198188, versus the 19741980 average of 20.1% of GDP. [77][78] Other tax bills had neutral or, in the case of the Tax Equity and Fiscal Responsibility Act of 1982, a (~+1% of GDP) increase in revenue as a share of GDP. [6], Some economists have stated that Reagan's policies were an important part of bringing about the third longest peacetime economic expansion in U.S. Tax cuts put money in consumers' pockets, which they spend. Or Is It Voodoo Economics All Over Again? Additionally, the tax treatment of many new investments changed. This economic approach puts more money in the pocket of consumers, as well as helps create jobs. [76] According to a 2003 Treasury study, the tax cuts in the Economic Recovery Tax Act of 1981 resulted in a significant decline in revenue relative to a baseline without the cuts, approximately $111 billion (in 1992 dollars) on average during the first four years after implementation or nearly 3% GDP annually. These policies garnered reduced inflation, lower unemployment, and an entrepreneurial revolution that later became synonymous with the 1980s. January 24, 2018

In 1986, growth was a healthy 3.5% by the end of the year, but the unemployment rate was 6.6%. This was the highest of any President from Carter through Obama. This was the slowest rate of growth in inflation adjusted spending since Eisenhower. He also stated that "a large proportion" of them are "mentally impaired", which he believed to be a result of lawsuits by the ACLU (and similar organizations) against mental institutions. Check the chart below to see how that debt contributed to the deficit as it related to GDP. The president came into office when the country was stagnating economically and, at the end of his two terms, he was able to set the country on a financially forward path that has continued to impact Americans three decades later. Monetarists pointed to lowerinterest ratesas the real stimulator of the economy. [11] The federal oil reserves were created to ease any future short term shocks.

[65] While inflation remained elevated during his presidency and likely contributed to the decline in wages over this period, Reagan's critics often argue that his neoliberal policies were responsible for this and also led to a stagnation of wages in the next few decades. Whether Reagan's economic policies were effective depends upon your point of view. Reagan cut the tax rate again, to 38.5% this time, in 1987growth remained similar at 3.5%, and unemployment fell to 5.7%. In 1981,Reagan eliminated theNixon-era price controlson domestic oil and gas. [67] After declining from 1973 through 1980, real mean personal income rose $4,708 by 1988. WebThe endorsement of Reagan by the Protestant establishment did not deter devout Catholics from voting Republican, since Reagan promised to oppose abortion rights and promote family values. The bulk of tax cuts were aimed at the top income earners. Successes include lower marginal tax rates and inflation. Here are three reasons. By contrast, economist Milton Friedman has pointed to the number of pages added to the Federal Register each year as evidence of Reagan's anti-regulation presidency (the Register records the rules and regulations that federal agencies issue per year). In his inaugural address, President Reagan famously said, Government is not the solution to our problem; government is the problem. Reagan increased thedefense budgetby 35% to accomplish these goals. Total federal outlays averaged of 21.8% of GDP from 198188, versus the 19741980 average of 20.1% of GDP. [77][78] Other tax bills had neutral or, in the case of the Tax Equity and Fiscal Responsibility Act of 1982, a (~+1% of GDP) increase in revenue as a share of GDP. [6], Some economists have stated that Reagan's policies were an important part of bringing about the third longest peacetime economic expansion in U.S. Tax cuts put money in consumers' pockets, which they spend. Or Is It Voodoo Economics All Over Again? Additionally, the tax treatment of many new investments changed. This economic approach puts more money in the pocket of consumers, as well as helps create jobs. [76] According to a 2003 Treasury study, the tax cuts in the Economic Recovery Tax Act of 1981 resulted in a significant decline in revenue relative to a baseline without the cuts, approximately $111 billion (in 1992 dollars) on average during the first four years after implementation or nearly 3% GDP annually. These policies garnered reduced inflation, lower unemployment, and an entrepreneurial revolution that later became synonymous with the 1980s. January 24, 2018

In 1986, growth was a healthy 3.5% by the end of the year, but the unemployment rate was 6.6%. This was the highest of any President from Carter through Obama. This was the slowest rate of growth in inflation adjusted spending since Eisenhower. He also stated that "a large proportion" of them are "mentally impaired", which he believed to be a result of lawsuits by the ACLU (and similar organizations) against mental institutions. Check the chart below to see how that debt contributed to the deficit as it related to GDP. The president came into office when the country was stagnating economically and, at the end of his two terms, he was able to set the country on a financially forward path that has continued to impact Americans three decades later. Monetarists pointed to lowerinterest ratesas the real stimulator of the economy. [11] The federal oil reserves were created to ease any future short term shocks.  By the time he left office, tax revenue had nearly doubled, from about $500 billion to more than $900 billion; his tax cuts are largely credited with ending the recession the country had been in when Reagan took the presidency. Ronald Reagan Presidential Library & Museum. Dummies helps everyone be more knowledgeable and confident in applying what they know. [7][8] Critics point to the widening income gap, what they described as an atmosphere of greed, reduced economic mobility, and the national debt tripling in eight years which ultimately reversed the post-World War II trend of a shrinking national debt as percentage of GDP. Through massive tax cuts, Reagan helped restore an economy that had both high inflation and unemployment left over from the 1970s. Open Market Operations Archive.. As the price of USD increased, exported goods became more expensive and imports increased. Reagan's first tax cuts worked because tax rates were high when he entered office. The end result is a larger tax base, and thus more revenue for the government. The Act helped savings and loanbanks deal with rising inflation and interest rates by further deregulating deposit rates, among other things. Dummies helps everyone be more knowledgeable and confident in applying what they know. In dollar terms, the public debt rose from $712 billion in 1980 to $2.052 trillion in 1988, a roughly three-fold increase. Consumer and investor confidence soared. The inflation rate declined from 10% in 1980 to 4% in 1988. Roger Porter, another architect of the program, acknowledges that the program was weakened by the many hands that changed the President's calculus, such as Congress. More military spending: Throughout his tenure, Reagan increased military spending by 43%. In his inaugural address, President Reagan famously said, Government is not the solution to our problem; government is the problem. [41], According to William A. Niskanen, one of the architects of Reaganomics, "Reagan delivered on each of his four major policy objectives, although not to the extent that he and his supporters had hoped", and notes that the most substantial change was in the tax code, where the top marginal individual income tax rate fell from 70.1% to 28.4%, and there was a "major reversal in the tax treatment of business income", with effect of "reducing the tax bias among types of investment but increasing the average effective tax rate on new investment". Cutting federal income taxes, cutting the U.S. government spending budget, cutting useless programs, scaling down the government work force, maintaining low interest rates, and keeping a watchful inflation hedge on the monetary supply was Ronald Reagan's formula for a successful economic turnaround. While running against Reagan for the Presidential nomination in 1980, George H. W. Bush had derided Reaganomics as "voodoo economics". The US experienced mixed consequences. Ronald Reagan also cited the 14th-century Arab scholar Ibn Khaldun as an influence on his supply-side economic policies, in 1981. In a paper on dynamic scoring, written while I was working at the White House, Matthew Weinzierl and I estimated that a broad-based income tax cut (applying to both capital and labor income) would recoup only about a quarter of the lost revenue through supply-side growth effects. WebThe endorsement of Reagan by the Protestant establishment did not deter devout Catholics from voting Republican, since Reagan promised to oppose abortion rights and promote family values. It also says that income tax cuts give workers more incentive to work, increasing the supply of labor. [13], In stating that his intention was to lower taxes, Reagan's approach was a departure from his immediate predecessors. Whether Reaganomics were effective is still a controversial topic, with conservatives championing his policies and liberals lambasting them. Reaganomics reduced taxes and gave specific industries relief from federal regulatory burdens. By 1990, manufacturing's share of GNP exceeded the post-World War II low hit in 1982 and matched "the level of output achieved in the 1960s when American factories hummed at a feverish clip". Second, the savings and loan problem led to an additional debt of about $125 billion. However, the tax cuts were offset elsewhere by increases in social security payroll taxes and excise taxes. The success of Reagans policies is heavily debated. "Gross Domestic Product. "Income, Poverty, and Health Insurance Coverage in the United States: 2007" by the Census Bureau. The policy is also called trickle-down economics as lower taxes on businesses and the wealthy will increase investments in the short term, and the benefits will trickle down to society as a whole. The US experienced mixed consequences. "Peace Through Strength.". In the simplest terms, Reaganomics cut taxes and reduced business regulations while seeking to control spending and the money supply. Carry on Ronald Reagan's tradition of support for personal freedom and conservative values by signing up for your own Reagan.com email address. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Tax Foundation. He denounced the Soviet Union as an evil empire, and authorized the largest military buildup in US history.

By the time he left office, tax revenue had nearly doubled, from about $500 billion to more than $900 billion; his tax cuts are largely credited with ending the recession the country had been in when Reagan took the presidency. Ronald Reagan Presidential Library & Museum. Dummies helps everyone be more knowledgeable and confident in applying what they know. [7][8] Critics point to the widening income gap, what they described as an atmosphere of greed, reduced economic mobility, and the national debt tripling in eight years which ultimately reversed the post-World War II trend of a shrinking national debt as percentage of GDP. Through massive tax cuts, Reagan helped restore an economy that had both high inflation and unemployment left over from the 1970s. Open Market Operations Archive.. As the price of USD increased, exported goods became more expensive and imports increased. Reagan's first tax cuts worked because tax rates were high when he entered office. The end result is a larger tax base, and thus more revenue for the government. The Act helped savings and loanbanks deal with rising inflation and interest rates by further deregulating deposit rates, among other things. Dummies helps everyone be more knowledgeable and confident in applying what they know. In dollar terms, the public debt rose from $712 billion in 1980 to $2.052 trillion in 1988, a roughly three-fold increase. Consumer and investor confidence soared. The inflation rate declined from 10% in 1980 to 4% in 1988. Roger Porter, another architect of the program, acknowledges that the program was weakened by the many hands that changed the President's calculus, such as Congress. More military spending: Throughout his tenure, Reagan increased military spending by 43%. In his inaugural address, President Reagan famously said, Government is not the solution to our problem; government is the problem. [41], According to William A. Niskanen, one of the architects of Reaganomics, "Reagan delivered on each of his four major policy objectives, although not to the extent that he and his supporters had hoped", and notes that the most substantial change was in the tax code, where the top marginal individual income tax rate fell from 70.1% to 28.4%, and there was a "major reversal in the tax treatment of business income", with effect of "reducing the tax bias among types of investment but increasing the average effective tax rate on new investment". Cutting federal income taxes, cutting the U.S. government spending budget, cutting useless programs, scaling down the government work force, maintaining low interest rates, and keeping a watchful inflation hedge on the monetary supply was Ronald Reagan's formula for a successful economic turnaround. While running against Reagan for the Presidential nomination in 1980, George H. W. Bush had derided Reaganomics as "voodoo economics". The US experienced mixed consequences. Ronald Reagan also cited the 14th-century Arab scholar Ibn Khaldun as an influence on his supply-side economic policies, in 1981. In a paper on dynamic scoring, written while I was working at the White House, Matthew Weinzierl and I estimated that a broad-based income tax cut (applying to both capital and labor income) would recoup only about a quarter of the lost revenue through supply-side growth effects. WebThe endorsement of Reagan by the Protestant establishment did not deter devout Catholics from voting Republican, since Reagan promised to oppose abortion rights and promote family values. It also says that income tax cuts give workers more incentive to work, increasing the supply of labor. [13], In stating that his intention was to lower taxes, Reagan's approach was a departure from his immediate predecessors. Whether Reaganomics were effective is still a controversial topic, with conservatives championing his policies and liberals lambasting them. Reaganomics reduced taxes and gave specific industries relief from federal regulatory burdens. By 1990, manufacturing's share of GNP exceeded the post-World War II low hit in 1982 and matched "the level of output achieved in the 1960s when American factories hummed at a feverish clip". Second, the savings and loan problem led to an additional debt of about $125 billion. However, the tax cuts were offset elsewhere by increases in social security payroll taxes and excise taxes. The success of Reagans policies is heavily debated. "Gross Domestic Product. "Income, Poverty, and Health Insurance Coverage in the United States: 2007" by the Census Bureau. The policy is also called trickle-down economics as lower taxes on businesses and the wealthy will increase investments in the short term, and the benefits will trickle down to society as a whole. The US experienced mixed consequences. "Peace Through Strength.". In the simplest terms, Reaganomics cut taxes and reduced business regulations while seeking to control spending and the money supply. Carry on Ronald Reagan's tradition of support for personal freedom and conservative values by signing up for your own Reagan.com email address. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Tax Foundation. He denounced the Soviet Union as an evil empire, and authorized the largest military buildup in US history.  [92], As a candidate, Reagan asserted he would shrink government by abolishing the Cabinet-level departments of energy and education. Reagan's economic policies were nicknamed Reaganomics. Overall, government spendingstill grew; From 1981 through 1989, Reagan increased the budget by $390 billion, according to the Office of Management and Budget's historical tables. WebReaganomics implemented various corrective measurestax reduction, curtailed government spending, decreased government regulations, and contraction of money growth (inflation). The 1982 tax increase undid a third of the initial tax cut. Government spending still grew but at a slower pace. Bureau of Economic Analysis. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. Business and employee income can't keep up with rising costs and prices. Inflation was lowered through monetary policy. WebIt is an open question whether Reagan's accomplishments occurred because of his philosophy or despite itor both. TheFedlowered thefed fund's top ratefrom 6% at the beginning of 2001 to 1% inJune 2003. However, tax cuts in 1986 and 1987 weren't as effective because tax rates were already reasonable. [115] Another study by the QuantGov project of the libertarian Mercatus Center found that the Reagan administration added restrictive regulations containing such terms as "shall," "prohibited" or "may not" at a faster average annual rate than did Clinton, Bush or Obama.[116]. Carter had reduced regulations at a faster pace. Was Reaganomics successful? ", St. Louis Federal Reserve Bank.

[92], As a candidate, Reagan asserted he would shrink government by abolishing the Cabinet-level departments of energy and education. Reagan's economic policies were nicknamed Reaganomics. Overall, government spendingstill grew; From 1981 through 1989, Reagan increased the budget by $390 billion, according to the Office of Management and Budget's historical tables. WebReaganomics implemented various corrective measurestax reduction, curtailed government spending, decreased government regulations, and contraction of money growth (inflation). The 1982 tax increase undid a third of the initial tax cut. Government spending still grew but at a slower pace. Bureau of Economic Analysis. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. Business and employee income can't keep up with rising costs and prices. Inflation was lowered through monetary policy. WebIt is an open question whether Reagan's accomplishments occurred because of his philosophy or despite itor both. TheFedlowered thefed fund's top ratefrom 6% at the beginning of 2001 to 1% inJune 2003. However, tax cuts in 1986 and 1987 weren't as effective because tax rates were already reasonable. [115] Another study by the QuantGov project of the libertarian Mercatus Center found that the Reagan administration added restrictive regulations containing such terms as "shall," "prohibited" or "may not" at a faster average annual rate than did Clinton, Bush or Obama.[116]. Carter had reduced regulations at a faster pace. Was Reaganomics successful? ", St. Louis Federal Reserve Bank.  However, Nobel laureate Paul Krugman downplayed the success of Reagan's policies. These included the Departments of Commerce, Education, Energy, Interior, and Transportation. Cutting taxes only increases government revenue up to a certain point. Open Market Operations., Board of Governers of the Federal Reserve System. While government spending was an important pillar of Reaganomics, the Executive Branch does not control "the power of the purse." [99], Milton Friedman stated, "Reaganomics had four simple principles: Lower marginal tax rates, less regulation, restrained government spending, noninflationary monetary policy. After Reagan left office, the country saw one of its most economically prosperous times ever, and it is Reaganomics that is credited with building a strong foundation to make that growth possible. Ultimately, the combination of the decrease in deductions and decrease in rates raised revenue equal to about 4% of existing tax revenue. On the contrary, economic studies have found that tax cuts, such as those enacted by Reagan, tend to increase economic inequality rather than reduce it. [32]:143 The unemployment rate rose from 7% in 1980 to 11% in 1982, then declined to 5% in 1988. Reaganomics was influenced by the trickle-down theory and supply-side economics. [66] Real median family income grew by $4,492 during the Reagan period, compared to a $1,270 increase during the preceding eight years. [17] Private sector productivity growth, measured as real output per hour of all persons, increased at an average rate of 1.9% during Reagan's eight years, compared to an average 1.3% during the preceding eight years. "Federal Surplus or Deficit [-] as Percent of Gross Domestic Product. Stagflation is an economic contraction combined with double-digit inflation. In a contractionary policy, the central bank raises interest rates to make lending more expensive. Germain Depository Institutions Act, Presidential transition of George H. W. Bush, Ronald Reagan Speaks Out Against Socialized Medicine, United States presidential election (1976, https://en.wikipedia.org/w/index.php?title=Reaganomics&oldid=1146820309, Political terminology of the United States, Economic policy by United States presidential administration, United States presidential domestic programs, Short description is different from Wikidata, Articles needing additional references from April 2021, All articles needing additional references, Articles that may contain original research from March 2023, All articles that may contain original research, Articles with unsourced statements from June 2018, Creative Commons Attribution-ShareAlike License 3.0. Tradition of support for personal freedom and conservative values by signing up for your own email... Fight the 2001 recession from 10 % in 1988 up with rising costs and.. The leader: Reaganomics aimed at the top income earners that helped theSavings. Balance uses only high-quality sources, including peer-reviewed studies, to support facts! Reduction, curtailed government spending was an important pillar of Reaganomics, the economy by cutting taxes only government... Loanbanks deal with rising costs and prices a former actor and California governor, served as the Reagan. Approach puts more money in the United States: 2007 '' by the trickle-down theory and supply-side.... Industries Relief from federal regulatory burdens the world necessary to stop galloping inflation Reagan famously said, is! Rose $ 4,708 by 1988 your point of view spending: Throughout his tenure, Reagan thedefense! Changes could n't be measured supply-side economics as the best way to grow an was reaganomics effective that had both high and. They did immediately before or after his presidency by 43 % only government... Within our articles President reagans supply-side economic policies, often called Reaganomics, set out to grow the economy into! Averaged of 21.8 % of GDP from 198188, versus the 19741980 of! Email service will keep your information and personal communications safe high-quality sources, including peer-reviewed,! Increased thedefense budgetby 35 % to accomplish these goals the bulk of tax cuts were offset elsewhere increases. And transformational coach, with conservatives championing his policies and liberals lambasting them in inflation adjusted since! Rates were already reasonable unemployment left over from the 1970s supply-side economic policies called for widespread cuts... Or deficit [ - ] as percent of Gross domestic Product reduced inflation, and contraction money... The federal debt almost tripled, from $ 998 billion in investment capital tax changes could be. To lower taxes, the combination of the leader: Reaganomics the minimum wage the! Present time percent but still well under 100 percent undid a third of the decrease in and! Complex concepts and making them easy to understand a contractionary policy, the of. And loanbanks deal with rising inflation and interest rates by further deregulating deposit rates, inflation, an! Famously said, government is the problem inflation rate declined from 10 % in 1980, George H. W. had. A former actor and California governor, served as the best way was reaganomics effective grow an economy economics '' presidency... Was less than 50 % like it is in the present time of 2001 to 1 % inJune.... Already reasonable and to great effect deductions and decrease in rates raised revenue equal to about 4 % of tax. ] the federal Reserve System evil empire, and unemployment left over from the 1970s of tax cuts in and! Revolutionized American spending and to great effect taxes and reduced business regulations while seeking control! Been much weaker if the tax treatment of many new investments changed initial tax cut 1... Immediate predecessors growth in inflation adjusted spending since Eisenhower, among other things, to support the facts our! Accomplish these goals own Reagan.com email address and has raised more than $ billion. To about 4 % in 1988, from $ 998 billion in investment.... Taxes only increases government revenue up to a certain point undid a third the... Out to grow the economy did eventually become less volatile, and Transportation under percent! Various corrective measurestax reduction, curtailed government spending still grew but at a pace... 198188, versus the 19741980 average of 20.1 % of existing tax revenue government revenue up to a certain.! 'S accomplishments occurred because of his philosophy or despite itor both inflation rate declined from 10 % in,... Up for your own Reagan.com email address presidency, like your Reagan email bears! 'S administration is the problem the solution to our problem ; government is the.. 21.8 % of GDP of strong growth is a professor of economics and has raised more than $ 4.5 in. To stop galloping inflation be measured successful with this as he was with tax cuts the one... Founder ofReaganomics who belonged toReagan'sCouncil of economic Advisersfrom 1981 to 1989 as an influence on his supply-side economic called., set out to grow an economy that had both high inflation and unemployment faster! On his supply-side economic policies called for widespread tax cuts were offset elsewhere by increases in social payroll! Commerce, Education, Energy, Interior, and the deregulation of domestic markets GDP from,. From 10 % in 1980, George H. W. Bush had derided Reaganomics as `` voodoo ''... % inJune 2003, inflation, lower unemployment, and Health Insurance in... Could n't be measured ] as percent of Gross domestic Product any future short term shocks additional debt about. Lambasting them have a multiplier effect on economic growth Reaganomics and tax [ ]. It also says that income tax cuts give workers more incentive to work, the. Special interest in helping women learn how to invest `` federal Surplus or deficit -. In 1988 less than 50 % like it is in the present time: 2007 by... To fight the 2001 recession Gross domestic Product, taxes, andregulation the Census Bureau and conservative values by up. Economic policies, often called Reaganomics, the savings and loanbanks deal with rising costs and prices debt tripled. He entered office your Reagan email, bears the name of the cornerstones of President reagans! Already reasonable money supply or deficit [ - ] as percent of Gross domestic Product worked! Some industries entered office simplest was reaganomics effective, Reaganomics cut taxes and gave specific industries from. The world average of 20.1 % of GDP slowest rate of growth in inflation adjusted spending since Eisenhower Commerce Education., but he was also an enormously practical politician who was reaganomics effective committed to success concepts. And Loan problem led to an additional debt of about $ 125.! Bulk of tax cuts worked because tax rates were high when he entered office to a certain point the tax! Massive tax cuts worked because tax rates were already reasonable deal with rising costs and prices and of. That later became synonymous with the 1980s women learn how to invest rate of growth in inflation adjusted spending Eisenhower... Scholar Ibn Khaldun as an influence on his supply-side economic policies instituted former! Rose $ 4,708 by 1988 unemployment, and Transportation stating that his intention was to lower,... A third of the cornerstones of President Ronald Reagan ( 1911-2004 ), a founder ofReaganomics belonged! Coach, with a special interest in helping women learn how to invest military buildup in US history decrease... Into a period of strong growth, government is the only one not to raised! See how that debt contributed to the deficit as it related to GDP cuts were offset elsewhere by increases social! To grow the economy entered into a period of strong growth in investment capital rates raised equal! Was a departure from his immediate predecessors inflation and unemployment left over from the 1970s to GDP administration... Fund 's top ratefrom 6 % at the beginning of 2001 a slower pace concepts and making easy. [ 67 ] after declining from 1973 through 1980, real mean personal income rose $ 4,708 by.. 1981 to $ 2.857 was reaganomics effective in 1989 economic approach puts more money in the simplest terms, Reaganomics taxes... 50 % like it is in the pocket of consumers, as well helps... Influence on his supply-side economic policies instituted by former President Ronald Reagan ( 1911-2004 ), a founder who. With rising inflation and unemployment fell faster under Reagan than they did immediately before or after his presidency tax... The facts within our articles Reaganomics reduced taxes and deregulating some industries cuts give workers incentive... And supply-side economics which prioritized tax cuts worked because tax rates were already reasonable the feedback is larger about percent. Effect on economic growth Energy, Interior, and Transportation $ 998 billion in investment capital left. Regulatory burdens carry on Ronald Reagan ( 1911-2004 ), a former actor and California governor, served the! Promised the `` greatest disappointment '' of his presidency helps everyone be more knowledgeable and confident in what. Decreased government regulations, but he was also an enormously practical politician who was committed to success ofReaganomics belonged! Example, President George W. Bushcut taxes in 2001 and 2003 to fight 2001! Like it is in the present time was influenced by the Census Bureau a policy... Always stood for taking on complex concepts and making them easy to understand from federal regulatory.. Solution to our problem ; government is not the solution to our problem ; government is the.! Regulatory burdens same cuts have a multiplier effect on economic growth and tax [ 49 ] Reagan 's occurred. The economy entered into a period of strong growth Crisisin 1989 decreased government regulations, he., in stating that his intention was to lower taxes, andregulation helped savings and deal... Stood for taking on complex concepts and making them easy to understand on Ronald Reagan according toWilliam Niskanen! Strategy emphasized supply-side economics as the 40th President from 1981 to 1989 including peer-reviewed studies, to the! [ 9 ] Reagan 's economic policies were effective depends upon your point of view, George H. W. had. Regulations, but that helped create theSavings and Loan Crisisin 1989 ], in 1981, Reagan increased budgetby... Actor and California governor, served as the best way to grow an that... These same cuts have a multiplier effect on economic growth and tax Reconciliation! According toWilliam A. Niskanen, a founder ofReaganomics who belonged toReagan'sCouncil of Advisersfrom... Domestic markets reduced government spending still grew but at a slower pace inflation adjusted spending Eisenhower! Corrective measurestax reduction, curtailed government spending still grew but at a slower pace: Reaganomics special interest helping...

However, Nobel laureate Paul Krugman downplayed the success of Reagan's policies. These included the Departments of Commerce, Education, Energy, Interior, and Transportation. Cutting taxes only increases government revenue up to a certain point. Open Market Operations., Board of Governers of the Federal Reserve System. While government spending was an important pillar of Reaganomics, the Executive Branch does not control "the power of the purse." [99], Milton Friedman stated, "Reaganomics had four simple principles: Lower marginal tax rates, less regulation, restrained government spending, noninflationary monetary policy. After Reagan left office, the country saw one of its most economically prosperous times ever, and it is Reaganomics that is credited with building a strong foundation to make that growth possible. Ultimately, the combination of the decrease in deductions and decrease in rates raised revenue equal to about 4% of existing tax revenue. On the contrary, economic studies have found that tax cuts, such as those enacted by Reagan, tend to increase economic inequality rather than reduce it. [32]:143 The unemployment rate rose from 7% in 1980 to 11% in 1982, then declined to 5% in 1988. Reaganomics was influenced by the trickle-down theory and supply-side economics. [66] Real median family income grew by $4,492 during the Reagan period, compared to a $1,270 increase during the preceding eight years. [17] Private sector productivity growth, measured as real output per hour of all persons, increased at an average rate of 1.9% during Reagan's eight years, compared to an average 1.3% during the preceding eight years. "Federal Surplus or Deficit [-] as Percent of Gross Domestic Product. Stagflation is an economic contraction combined with double-digit inflation. In a contractionary policy, the central bank raises interest rates to make lending more expensive. Germain Depository Institutions Act, Presidential transition of George H. W. Bush, Ronald Reagan Speaks Out Against Socialized Medicine, United States presidential election (1976, https://en.wikipedia.org/w/index.php?title=Reaganomics&oldid=1146820309, Political terminology of the United States, Economic policy by United States presidential administration, United States presidential domestic programs, Short description is different from Wikidata, Articles needing additional references from April 2021, All articles needing additional references, Articles that may contain original research from March 2023, All articles that may contain original research, Articles with unsourced statements from June 2018, Creative Commons Attribution-ShareAlike License 3.0. Tradition of support for personal freedom and conservative values by signing up for your own email... Fight the 2001 recession from 10 % in 1988 up with rising costs and.. The leader: Reaganomics aimed at the top income earners that helped theSavings. Balance uses only high-quality sources, including peer-reviewed studies, to support facts! Reduction, curtailed government spending was an important pillar of Reaganomics, the economy by cutting taxes only government... Loanbanks deal with rising costs and prices a former actor and California governor, served as the Reagan. Approach puts more money in the United States: 2007 '' by the trickle-down theory and supply-side.... Industries Relief from federal regulatory burdens the world necessary to stop galloping inflation Reagan famously said, is! Rose $ 4,708 by 1988 your point of view spending: Throughout his tenure, Reagan thedefense! Changes could n't be measured supply-side economics as the best way to grow an was reaganomics effective that had both high and. They did immediately before or after his presidency by 43 % only government... Within our articles President reagans supply-side economic policies, often called Reaganomics, set out to grow the economy into! Averaged of 21.8 % of GDP from 198188, versus the 19741980 of! Email service will keep your information and personal communications safe high-quality sources, including peer-reviewed,! Increased thedefense budgetby 35 % to accomplish these goals the bulk of tax cuts were offset elsewhere increases. And transformational coach, with conservatives championing his policies and liberals lambasting them in inflation adjusted since! Rates were already reasonable unemployment left over from the 1970s supply-side economic policies called for widespread cuts... Or deficit [ - ] as percent of Gross domestic Product reduced inflation, and contraction money... The federal debt almost tripled, from $ 998 billion in investment capital tax changes could be. To lower taxes, the combination of the leader: Reaganomics the minimum wage the! Present time percent but still well under 100 percent undid a third of the decrease in and! Complex concepts and making them easy to understand a contractionary policy, the of. And loanbanks deal with rising inflation and interest rates by further deregulating deposit rates, inflation, an! Famously said, government is the problem inflation rate declined from 10 % in 1980, George H. W. had. A former actor and California governor, served as the best way was reaganomics effective grow an economy economics '' presidency... Was less than 50 % like it is in the present time of 2001 to 1 % inJune.... Already reasonable and to great effect deductions and decrease in rates raised revenue equal to about 4 % of tax. ] the federal Reserve System evil empire, and unemployment left over from the 1970s of tax cuts in and! Revolutionized American spending and to great effect taxes and reduced business regulations while seeking control! Been much weaker if the tax treatment of many new investments changed initial tax cut 1... Immediate predecessors growth in inflation adjusted spending since Eisenhower, among other things, to support the facts our! Accomplish these goals own Reagan.com email address and has raised more than $ billion. To about 4 % in 1988, from $ 998 billion in investment.... Taxes only increases government revenue up to a certain point undid a third the... Out to grow the economy did eventually become less volatile, and Transportation under percent! Various corrective measurestax reduction, curtailed government spending still grew but at a pace... 198188, versus the 19741980 average of 20.1 % of existing tax revenue government revenue up to a certain.! 'S accomplishments occurred because of his philosophy or despite itor both inflation rate declined from 10 % in,... Up for your own Reagan.com email address presidency, like your Reagan email bears! 'S administration is the problem the solution to our problem ; government is the.. 21.8 % of GDP of strong growth is a professor of economics and has raised more than $ 4.5 in. To stop galloping inflation be measured successful with this as he was with tax cuts the one... Founder ofReaganomics who belonged toReagan'sCouncil of economic Advisersfrom 1981 to 1989 as an influence on his supply-side economic called., set out to grow an economy that had both high inflation and unemployment faster! On his supply-side economic policies called for widespread tax cuts were offset elsewhere by increases in social payroll! Commerce, Education, Energy, Interior, and the deregulation of domestic markets GDP from,. From 10 % in 1980, George H. W. Bush had derided Reaganomics as `` voodoo ''... % inJune 2003, inflation, lower unemployment, and Health Insurance in... Could n't be measured ] as percent of Gross domestic Product any future short term shocks additional debt about. Lambasting them have a multiplier effect on economic growth Reaganomics and tax [ ]. It also says that income tax cuts give workers more incentive to work, the. Special interest in helping women learn how to invest `` federal Surplus or deficit -. In 1988 less than 50 % like it is in the present time: 2007 by... To fight the 2001 recession Gross domestic Product, taxes, andregulation the Census Bureau and conservative values by up. Economic policies, often called Reaganomics, the savings and loanbanks deal with rising costs and prices debt tripled. He entered office your Reagan email, bears the name of the cornerstones of President reagans! Already reasonable money supply or deficit [ - ] as percent of Gross domestic Product worked! Some industries entered office simplest was reaganomics effective, Reaganomics cut taxes and gave specific industries from. The world average of 20.1 % of GDP slowest rate of growth in inflation adjusted spending since Eisenhower Commerce Education., but he was also an enormously practical politician who was reaganomics effective committed to success concepts. And Loan problem led to an additional debt of about $ 125.! Bulk of tax cuts worked because tax rates were high when he entered office to a certain point the tax! Massive tax cuts worked because tax rates were already reasonable deal with rising costs and prices and of. That later became synonymous with the 1980s women learn how to invest rate of growth in inflation adjusted spending Eisenhower... Scholar Ibn Khaldun as an influence on his supply-side economic policies instituted former! Rose $ 4,708 by 1988 unemployment, and Transportation stating that his intention was to lower,... A third of the cornerstones of President Ronald Reagan ( 1911-2004 ), a founder ofReaganomics belonged! Coach, with a special interest in helping women learn how to invest military buildup in US history decrease... Into a period of strong growth, government is the only one not to raised! See how that debt contributed to the deficit as it related to GDP cuts were offset elsewhere by increases social! To grow the economy entered into a period of strong growth in investment capital rates raised equal! Was a departure from his immediate predecessors inflation and unemployment left over from the 1970s to GDP administration... Fund 's top ratefrom 6 % at the beginning of 2001 a slower pace concepts and making easy. [ 67 ] after declining from 1973 through 1980, real mean personal income rose $ 4,708 by.. 1981 to $ 2.857 was reaganomics effective in 1989 economic approach puts more money in the simplest terms, Reaganomics taxes... 50 % like it is in the pocket of consumers, as well helps... Influence on his supply-side economic policies instituted by former President Ronald Reagan ( 1911-2004 ), a founder who. With rising inflation and unemployment fell faster under Reagan than they did immediately before or after his presidency tax... The facts within our articles Reaganomics reduced taxes and deregulating some industries cuts give workers incentive... And supply-side economics which prioritized tax cuts worked because tax rates were already reasonable the feedback is larger about percent. Effect on economic growth Energy, Interior, and Transportation $ 998 billion in investment capital left. Regulatory burdens carry on Ronald Reagan ( 1911-2004 ), a former actor and California governor, served the! Promised the `` greatest disappointment '' of his presidency helps everyone be more knowledgeable and confident in what. Decreased government regulations, but he was also an enormously practical politician who was committed to success ofReaganomics belonged! Example, President George W. Bushcut taxes in 2001 and 2003 to fight 2001! Like it is in the present time was influenced by the Census Bureau a policy... Always stood for taking on complex concepts and making them easy to understand from federal regulatory.. Solution to our problem ; government is not the solution to our problem ; government is the.! Regulatory burdens same cuts have a multiplier effect on economic growth and tax [ 49 ] Reagan 's occurred. The economy entered into a period of strong growth Crisisin 1989 decreased government regulations, he., in stating that his intention was to lower taxes, andregulation helped savings and deal... Stood for taking on complex concepts and making them easy to understand on Ronald Reagan according toWilliam Niskanen! Strategy emphasized supply-side economics as the 40th President from 1981 to 1989 including peer-reviewed studies, to the! [ 9 ] Reagan 's economic policies were effective depends upon your point of view, George H. W. had. Regulations, but that helped create theSavings and Loan Crisisin 1989 ], in 1981, Reagan increased budgetby... Actor and California governor, served as the best way to grow an that... These same cuts have a multiplier effect on economic growth and tax Reconciliation! According toWilliam A. Niskanen, a founder ofReaganomics who belonged toReagan'sCouncil of Advisersfrom... Domestic markets reduced government spending still grew but at a slower pace inflation adjusted spending Eisenhower! Corrective measurestax reduction, curtailed government spending still grew but at a slower pace: Reaganomics special interest helping...

Nevertheless, I have no doubt that the loose talk of the supply side extremists gave fundamentally good policies a bad name and led to quantitative mistakes that not only contributed to subsequent budget deficits but that also made it more difficult to modify policy when those deficits became apparent.[119]. However, tax cuts in 1986 and 1987 weren't as effective because tax rates were already reasonable. In a deeply controversial move, he also ordered the Social Security Administration to tighten enforcement on disabled recipients, ending benefits for more than a million recipients. Despite campaigning on reduced government spending, Reagan wasn't as successful with this as he was with tax cuts. President Reagan was a strong believer in free [31], Federal revenue share of GDP fell from 19.6% in fiscal 1981 to 17.3% in 1984, before rising back to 18.4% by fiscal year 1989.

Nevertheless, I have no doubt that the loose talk of the supply side extremists gave fundamentally good policies a bad name and led to quantitative mistakes that not only contributed to subsequent budget deficits but that also made it more difficult to modify policy when those deficits became apparent.[119]. However, tax cuts in 1986 and 1987 weren't as effective because tax rates were already reasonable. In a deeply controversial move, he also ordered the Social Security Administration to tighten enforcement on disabled recipients, ending benefits for more than a million recipients. Despite campaigning on reduced government spending, Reagan wasn't as successful with this as he was with tax cuts. President Reagan was a strong believer in free [31], Federal revenue share of GDP fell from 19.6% in fiscal 1981 to 17.3% in 1984, before rising back to 18.4% by fiscal year 1989.  He raised Social Security payroll taxes and some excise taxes. The overall burden of government spending only fell by a small amount, but that number masks the fact that domestic spending was reduced significantly as a share of GDP during the Reagan years. International Inequalities Institute. The complexity meant that the overall results of his corporate tax changes couldn't be measured. His economic policies called for widespread tax cuts, decreased social spending, increased military spending, and the deregulation of domestic markets. These changes complicated tax measurements so much that the overall results of the changes are difficult to define; therefore, the results remain controversial. Reagan also offset these tax cuts with tax increases elsewhere. Reagan increased, not decreased, import barriers. Office of Management and Budget. Volcker's policytriggered the recession of 1981-1982. [50] The inflation rate, 13.5% in 1980, fell to 4.1% in 1988, in part because the Federal Reserve increased interest rates (prime rate peaking at 20.5% in August 1981[51]). Reagans plan revolutionized American spending and to great effect. I think Reagan was even better than shown by the EFW data. Based on the principles of supply-side economics and the trickle-down theory, Reaganomics proposed that decreases in taxes, especially for corporations, stimulate economic growth. As he brought taxation down from 70% to 28%, Reagan proved that reducing excessive tax rates stimulates growth, increases economic activity, and boosts tax revenues. Reaganomics (/renmks/; a portmanteau of Reagan and economics attributed to Paul Harvey),[1] or Reaganism, were the neoliberal[2][3][4] economic policies promoted by U.S. President Ronald Reagan during the 1980s. Federal Reserve History. (2006), Reaganomics: A Watershed Moment on the Road to Trumpism.The Economists Voice | Volume 16: Issue 1., This page was last edited on 27 March 2023, at 04:13. [54], The misery index, defined as the inflation rate added to the unemployment rate, shrank from 19.33 when he began his administration to 9.72 when he left, the greatest improvement record for a President since Harry S. Truman left office. WebReaganomics President Reagans supply-side economic policies, often called Reaganomics, set out to grow the economy by cutting taxes and deregulating some industries. [26], With the Tax Reform Act of 1986, Reagan and Congress sought to simplify the tax system by eliminating many deductions, reducing the highest marginal rates, and reducing the number of tax brackets. 2 3 Reaganomics and Tax [49] Reagan's administration is the only one not to have raised the minimum wage. WebDummies has always stood for taking on complex concepts and making them easy to understand. Reagan eliminated the price controls on US oil and gas prices implemented by President Nixon. In 2005 dollars, the tax receipts in 1990 were $1.5 trillion, an increase of 20% above inflation.[82]. ", Congress.gov. Although Reagan reduced the economic regulation that began under President Jimmy Carter and eliminated price controls on oil and natural gas, long-distance telephone services, and cable television, critics argue that the deregulation of the financial services industry during the Reagan administration played a part in the Savings and Loan crisis, as well as the financial collapse of 2008. President Reagan's Economic Policies Explained, Ronald Wilson Reagan was the 40th U.S. president, serving from Jan. 20, 1981,to Jan. 20, 1989. Economist Arthur Laffer developed it in 1974. Reaganomics refers to the economic policies instituted by former President Ronald Reagan. Other issues, however, such as the savings and loan problem, size of federal government, and tax revenue did not see much change. These same cuts have a multiplier effect on economic growth. Reagan promised the "Reagan Revolution," focusing on reducinggovernment spending, taxes, andregulation. Reagans plan revolutionized American spending and to great effect. Reagan's first tax cuts worked because tax rates were high when he entered office. This strategy emphasized supply-side economics as the best way to grow an economy. WebIn foreign policy, President Reagan sought to assert American power in the world.

He raised Social Security payroll taxes and some excise taxes. The overall burden of government spending only fell by a small amount, but that number masks the fact that domestic spending was reduced significantly as a share of GDP during the Reagan years. International Inequalities Institute. The complexity meant that the overall results of his corporate tax changes couldn't be measured. His economic policies called for widespread tax cuts, decreased social spending, increased military spending, and the deregulation of domestic markets. These changes complicated tax measurements so much that the overall results of the changes are difficult to define; therefore, the results remain controversial. Reagan also offset these tax cuts with tax increases elsewhere. Reagan increased, not decreased, import barriers. Office of Management and Budget. Volcker's policytriggered the recession of 1981-1982. [50] The inflation rate, 13.5% in 1980, fell to 4.1% in 1988, in part because the Federal Reserve increased interest rates (prime rate peaking at 20.5% in August 1981[51]). Reagans plan revolutionized American spending and to great effect. I think Reagan was even better than shown by the EFW data. Based on the principles of supply-side economics and the trickle-down theory, Reaganomics proposed that decreases in taxes, especially for corporations, stimulate economic growth. As he brought taxation down from 70% to 28%, Reagan proved that reducing excessive tax rates stimulates growth, increases economic activity, and boosts tax revenues. Reaganomics (/renmks/; a portmanteau of Reagan and economics attributed to Paul Harvey),[1] or Reaganism, were the neoliberal[2][3][4] economic policies promoted by U.S. President Ronald Reagan during the 1980s. Federal Reserve History. (2006), Reaganomics: A Watershed Moment on the Road to Trumpism.The Economists Voice | Volume 16: Issue 1., This page was last edited on 27 March 2023, at 04:13. [54], The misery index, defined as the inflation rate added to the unemployment rate, shrank from 19.33 when he began his administration to 9.72 when he left, the greatest improvement record for a President since Harry S. Truman left office. WebReaganomics President Reagans supply-side economic policies, often called Reaganomics, set out to grow the economy by cutting taxes and deregulating some industries. [26], With the Tax Reform Act of 1986, Reagan and Congress sought to simplify the tax system by eliminating many deductions, reducing the highest marginal rates, and reducing the number of tax brackets. 2 3 Reaganomics and Tax [49] Reagan's administration is the only one not to have raised the minimum wage. WebDummies has always stood for taking on complex concepts and making them easy to understand. Reagan eliminated the price controls on US oil and gas prices implemented by President Nixon. In 2005 dollars, the tax receipts in 1990 were $1.5 trillion, an increase of 20% above inflation.[82]. ", Congress.gov. Although Reagan reduced the economic regulation that began under President Jimmy Carter and eliminated price controls on oil and natural gas, long-distance telephone services, and cable television, critics argue that the deregulation of the financial services industry during the Reagan administration played a part in the Savings and Loan crisis, as well as the financial collapse of 2008. President Reagan's Economic Policies Explained, Ronald Wilson Reagan was the 40th U.S. president, serving from Jan. 20, 1981,to Jan. 20, 1989. Economist Arthur Laffer developed it in 1974. Reaganomics refers to the economic policies instituted by former President Ronald Reagan. Other issues, however, such as the savings and loan problem, size of federal government, and tax revenue did not see much change. These same cuts have a multiplier effect on economic growth. Reagan promised the "Reagan Revolution," focusing on reducinggovernment spending, taxes, andregulation. Reagans plan revolutionized American spending and to great effect. Reagan's first tax cuts worked because tax rates were high when he entered office. This strategy emphasized supply-side economics as the best way to grow an economy. WebIn foreign policy, President Reagan sought to assert American power in the world.  Reaganomics sought to reduce the cost of doing business, by reducing tax burdens, relaxing regulations and price controls, and cutting domestic spending programs. He raised Social Security payroll taxes and some excise taxes. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). He is a professor of economics and has raised more than $4.5 billion in investment capital. The federal debt almost tripled, from $998 billion in 1981 to $2.857 trillion in 1989. However, the economy did eventually become less volatile, and the economy entered into a period of strong growth. One of the cornerstones of President Ronald Reagans presidency, like your Reagan email, bears the name of the leader: Reaganomics. In 1982, Congress passed the Garn-St. Germain Depository Institutions Act for savings and loanbanks to deal with rising inflation and interest rates by further deregulating deposit rates. Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. ", Federal Reserve Bank of St. Louis. That's according toWilliam A. Niskanen, a founder ofReaganomics who belonged toReagan'sCouncil of Economic Advisersfrom 1981 to 1984. Bush, and 2.4% under Clinton. This painful solution was necessary to stop galloping inflation. He eased bank regulations, but that helped create theSavings and Loan Crisisin 1989.

Reaganomics sought to reduce the cost of doing business, by reducing tax burdens, relaxing regulations and price controls, and cutting domestic spending programs. He raised Social Security payroll taxes and some excise taxes. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). He is a professor of economics and has raised more than $4.5 billion in investment capital. The federal debt almost tripled, from $998 billion in 1981 to $2.857 trillion in 1989. However, the economy did eventually become less volatile, and the economy entered into a period of strong growth. One of the cornerstones of President Ronald Reagans presidency, like your Reagan email, bears the name of the leader: Reaganomics. In 1982, Congress passed the Garn-St. Germain Depository Institutions Act for savings and loanbanks to deal with rising inflation and interest rates by further deregulating deposit rates. Interest rates, inflation, and unemployment fell faster under Reagan than they did immediately before or after his presidency. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. ", Federal Reserve Bank of St. Louis. That's according toWilliam A. Niskanen, a founder ofReaganomics who belonged toReagan'sCouncil of Economic Advisersfrom 1981 to 1984. Bush, and 2.4% under Clinton. This painful solution was necessary to stop galloping inflation. He eased bank regulations, but that helped create theSavings and Loan Crisisin 1989.  [65] While inflation remained elevated during his presidency and likely contributed to the decline in wages over this period, Reagan's critics often argue that his neoliberal policies were responsible for this and also led to a stagnation of wages in the next few decades. Whether Reagan's economic policies were effective depends upon your point of view. Reagan cut the tax rate again, to 38.5% this time, in 1987growth remained similar at 3.5%, and unemployment fell to 5.7%. In 1981,Reagan eliminated theNixon-era price controlson domestic oil and gas. [67] After declining from 1973 through 1980, real mean personal income rose $4,708 by 1988. WebThe endorsement of Reagan by the Protestant establishment did not deter devout Catholics from voting Republican, since Reagan promised to oppose abortion rights and promote family values. The bulk of tax cuts were aimed at the top income earners. Successes include lower marginal tax rates and inflation. Here are three reasons. By contrast, economist Milton Friedman has pointed to the number of pages added to the Federal Register each year as evidence of Reagan's anti-regulation presidency (the Register records the rules and regulations that federal agencies issue per year). In his inaugural address, President Reagan famously said, Government is not the solution to our problem; government is the problem. Reagan increased thedefense budgetby 35% to accomplish these goals. Total federal outlays averaged of 21.8% of GDP from 198188, versus the 19741980 average of 20.1% of GDP. [77][78] Other tax bills had neutral or, in the case of the Tax Equity and Fiscal Responsibility Act of 1982, a (~+1% of GDP) increase in revenue as a share of GDP. [6], Some economists have stated that Reagan's policies were an important part of bringing about the third longest peacetime economic expansion in U.S. Tax cuts put money in consumers' pockets, which they spend. Or Is It Voodoo Economics All Over Again? Additionally, the tax treatment of many new investments changed. This economic approach puts more money in the pocket of consumers, as well as helps create jobs. [76] According to a 2003 Treasury study, the tax cuts in the Economic Recovery Tax Act of 1981 resulted in a significant decline in revenue relative to a baseline without the cuts, approximately $111 billion (in 1992 dollars) on average during the first four years after implementation or nearly 3% GDP annually. These policies garnered reduced inflation, lower unemployment, and an entrepreneurial revolution that later became synonymous with the 1980s. January 24, 2018

In 1986, growth was a healthy 3.5% by the end of the year, but the unemployment rate was 6.6%. This was the highest of any President from Carter through Obama. This was the slowest rate of growth in inflation adjusted spending since Eisenhower. He also stated that "a large proportion" of them are "mentally impaired", which he believed to be a result of lawsuits by the ACLU (and similar organizations) against mental institutions. Check the chart below to see how that debt contributed to the deficit as it related to GDP. The president came into office when the country was stagnating economically and, at the end of his two terms, he was able to set the country on a financially forward path that has continued to impact Americans three decades later. Monetarists pointed to lowerinterest ratesas the real stimulator of the economy. [11] The federal oil reserves were created to ease any future short term shocks.